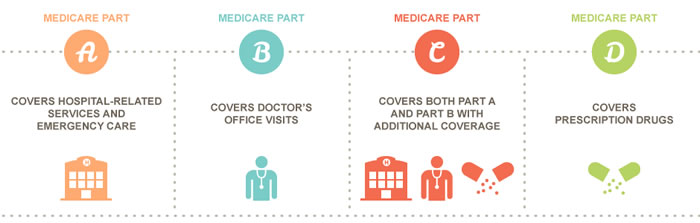

Medicare Basics and Plans

To learn about Medicare Basics & Plan’s Coverages we need to first understand Medicare. Medicare is the federal government program that gives you health care coverage (health insurance) if you are 65 or older, or under 65 and have a disability, no matter your income. When you pay taxes on your income, part of the money goes toward Medicare. The centers for Medicare and Medicaid Services (CMS), is the federal agency that oversees Medicare.

The Medicare program is different from the Medicaid program. Medicaid is a state and federal program offering health care coverage to people of most ages in certain groups, but generally only to those with low incomes.

Medicare Part A

Medicare Part A covers Medicare inpatient care. This includes care received while in a hospital, a skilled nursing facility, and through home health care.

Most people are automatically eligible for Medicare Part A at age 65 if they have worked at least 10 years or 40 quarters and paid Medicare taxes during that time. You may qualify for Medicare Part A before 65 if you have a disability, end-stage renal disease (ESRD), or amyotrophic lateral sclerosis (ALS).

In general, Medicare Part A coverage includes:

1. Inpatient hospital care such as semi-private rooms, meals, general nursing, and drugs as part of your inpatient treatment, and other hospital services and supplies.

2. Home health services such as medically necessary part-time or intermittent skilled nursing care, and/or services for people with a continuing need for occupational therapy.

3. Hospice care coverage includes all items and services needed for pain relief and symptom management. Drugs and certain durable medical equipment. Medical, nursing, and social services.

4. Skilled nursing inpatient care in a facility (not custodial or long term care). Medicare helps cover semi-private rooms, meals, skilled nursing, and rehabilitative services, and other medically necessary services and supplies after a 3-day minimum medically necessary inpatient hospital stay for a related illness or injury. An inpatient hospital stay begins the day you are formally admitted with a doctor’s order. It does not include the day you are discharged.

Medicare Part B

Medicare Part B (medical insurance) is part of Original Medicare and covers services and supplies that are medically necessary to treat your health condition. This can include outpatient care, preventive services, ambulance services, and durable medical equipment. It also covers part-time or intermittent home health and rehabilitative services, such as physical therapy, if they are ordered by a doctor to treat your condition.

Some of the preventive services Medicare Part B covers include a one-time “Welcome to Medicare” physical exam, flu and hepatitis B shots, cardiovascular screenings, cancer screenings, diabetes screenings, and more.

In general, Medicare Part B coverage includes:

1. Doctors’ services – medically necessary doctor services, including outpatient services and some doctor services you get when you’re a hospital inpatient.

2. Ambulatory Surgical Centers – Medicare helps cover the facility services fees related to approved surgical procedures in an ambulatory center, where surgical procedures are performed, and the patient is expected to be released within 24 hours.

3. Ambulance Services – Medicare helps cover ground ambulance transportation when you need to be transported to a hospital, critical address hospital, or skilled nursing facility for medically necessary services and transportation in any other vehicle could endanger your health.

4. Chemotherapy – Medicare helps cover chemotherapy in a doctor’s office, freestanding clinic, or hospital outpatient setting for people with cancer.

5. Durable Medical Equipment Equipment – Medicare helps cover items like oxygen equipment and supplies, wheelchairs, walkers, and hospital beds ordered by a doctor or other health care provider enrolled in Medicare for use in the home.

Medicare Part C

If you qualify for or are already enrolled in Original Medicare, you can choose to enroll in Medicare Part C, more commonly known as Medicare Advantage. Medicare Advantage plans are offered by private health insurance companies and provide Medicare Part A and Part B coverage (hospital and medical benefits).

You might wonder why a beneficiary would choose to enroll in Medicare Advantage. A Medicare Advantage plan generally covers everything that Original Medicare covers, including emergency and urgent care. But, there can be some differences between Original Medicare and Medicare Advantage. Those differences can be in how much you pay out of your own pocket when you receive health care.

For example, you might have lower co-payments and coinsurance or a smaller deductible.

In general, Medicare Part C coverage includes:

1. A Medicare Advantage Plan is another way to get your Medicare coverage. A Medicare Advantage Plan is a type of Medicare health plan offered by a private company that contracts with Medicare to provide you with all your Part A and Part B benefits.

2. Medicare Advantage Plans include HMOs, and PPOs. If you are enrolled in a Medicare Advantage Plan, Medicare services are covered through the plan and aren’t paid for under Original Medicare. Most Medicare Advantage plans also come with a Part D Prescription drug plan included as part of the plan at no extra charge.

3. You can join a Medicare Advantage Plan even if you have a pre-existing condition, except for End-Stage Renal Disease (ERSD). To join a Medicate Advantage Plan you must have Medicare Parts A and B, and you must live in the Plan’s service area.

4. A Medicare Supplement (Medigap) policy is different from a Medicare Advantage Plan. Medicare Advantage Plans are a way to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. You have to pay a monthly premium for a Medicare Supplement (Medigap) Insurance policy, and a separate premium for a Part D prescription drug plan.

5. Medicare Supplement (Medigap) insurance, sold by private companies, can help pay some of the health care costs that Original Medicare doesn’t cover, like co-payments, coinsurance, and deductibles.

Medicare Part D

Medicare Part D prescription drug coverage, often referred to as Part D, is available from private insurers to anyone who is also eligible for Original Medicare and permanently resides in the service area of a Medicare Prescription Drug Plan. Different insurers offer different types of plans, so your premium and out-of-pocket expenses for prescription drugs will vary.

Typically you pay a monthly premium to be covered under the plan. Also, you should be aware of variations in the coverage and cost-sharing associated with plans.

In general, Medicare Part D coverage includes:

1. Medicare Prescription Drug Plans (Part D), provides eligible individuals with prescription drug coverage since Original Medicare benefits do not cover most medications.

2. If you do not enroll in a Part D plan when you are first eligible and do not have creditable prescription drug coverage (for example, from a current or former employer or union), you may have to pay a late penalty for each full uncovered month that you were eligible but without creditable insurance. You may have to pay this penalty for as long as you have a Medicare Drug Plan.

3. Each plan can vary in cost and the list of drugs that are covered, so it’s important to choose the right one for your needs.

4. Most Drug Plans charge a monthly fee that varies by plan. If you enroll in a Medicare Advantage Plan (Part C), you usually get prescription drug coverage (Part D) included as part of the plan at no extra charge.